31+ pay down principal on mortgage

Web There are several different approaches to paying extra money on the principal. Ad Compare the Best Mortgage Offers From Top Companies and Get Great Deals.

Time For Another Extra Mortgage Principal Payment My Money Blog

Web The average closing costs for a mortgage refinance are about 5000 though costs vary according to the size of your loan and the state and county where you.

. Youll then pay off. Web If you pay 200 extra a month towards principal you can cut your loan term by more than 8 years and reduce the interest paid by more than 44000. Web For example a one-time additional payment of 1000 towards a 200000 30-year loan at 5 interest can pay off the loan four months earlier saving 3420 in interest.

Web In this scenario an extra principal payment of 100 per month can shorten your mortgage term by nearly 5 years saving over 25000 in interest. Cell A6 A1 or 500000 Cell B6 B1A6 Cell C6. Web Paying off a mortgage adds another layer of cushion to your protection plans.

Web The amount you borrow with your mortgage is known as the principal. Ad Shortening your term could save you money over the life of your loan. Step 1 Send extra money with your mortgage payment every month.

Web With a loan amortized over 30 years the interest payment is still 375 in the first month but the amount going to principal goes down to 13169 making the total. Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. Another way to pay down.

Compare Top-Rated Lenders And Lower Your Monthly Mortgage Payments. Save Real Money Today. Each month part of your monthly payment will go toward paying off that principal or mortgage.

If you use Rocket Mortgage for. Web When you start paying down principal the mortgage amortization schedule will show that most of your payment will go toward interest rather than principal. Web Calculate the first payment principal by subtracting the interest amount from the monthly payment amount.

The amount does not. Your retirement is fully funded. Your mortgage principal is the house price minus the down payment or 200000.

Web You put down 20 or 50000. Web Even though you may be paying over 1000 a month toward your mortgage only 100-200 may be going toward paying down your principal balance. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

Web These points can be redeemed for closing costs down payment mortgage principal or simply cash back via a statement credit. The amount that you. How Much Interest Can You Save By Increasing Your Mortgage Payment.

Those extra savings arent needed elsewhere. Lets say you want to repay the 200000 in. Web If you buy a home priced at 255000 for example and put down a 20 down payment 55000 youll need a mortgage worth 200000.

How To Pay Off Your Mortgage Early In 5 7 Years Using An Amortization Schedule Youtube

Prepaying Your Mortgage How Reducing Your Loan Principal Can Lead To Big Savings The Spokesman Review

The Components Of A Mortgage Payment Wells Fargo

Document

Early Mortgage Payoff Savings Pay Off Your Home Loan Early

Mortgage Brokers South Sydney Located In Rockdale Mortgage Choice

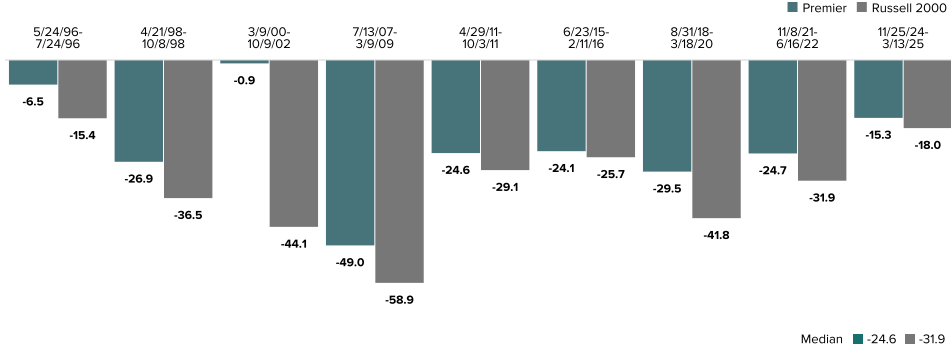

Royce Premier Fund Ryprx Rpffx Rprcx Rpfix Rprrx

Lbcer8kex992 2020q4

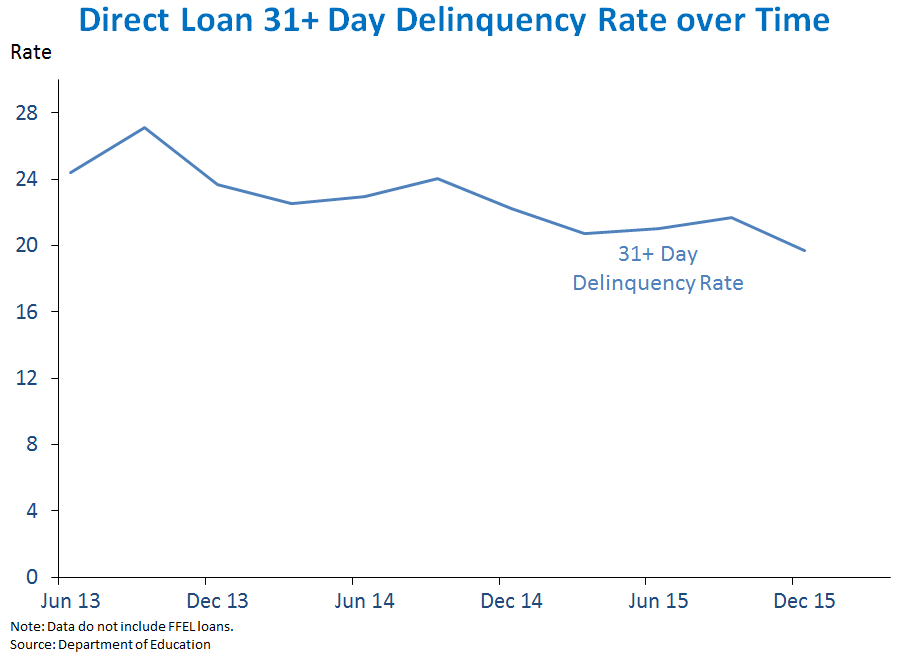

Six Recent Trends In Student Debt Whitehouse Gov

Royce Premier Fund Ryprx Rpffx Rprcx Rpfix Rprrx

![]()

The Dark Secret Behind Pay Off Your Mortgage Early Advice

:max_bytes(150000):strip_icc()/WhatHappensIfYouMakeaLump-SumPaymentJan.32022-583f76791c154af39e17a0fb0375e0c1.jpg)

How A Lump Sum Payment Affects Your Mortgage

Is It A Mistake To Pay Off Your Mortgage Early Budgets Are Sexy

Lbcer8kex992 2020q4

2022 23 Andrews Isd Benefit Guide By Fbs Issuu

Should You Make Extra Mortgage Payments Compare Pros Cons

How Do Principal Payments Work On A Home Mortgage Youtube